54+ what percentage of gross income should go to mortgage

The Best Second Mortgage Rates. Ad Calculate Your Payment with 0 Down.

Sometimes People May Say The Interest Rate Is Negative What Would That Mean That S Definitely Not The Standard Definition Like Borrowing Costs Right Otherwise Borrowing Infinity Is An Arbitrage How Is It

The Best Second Mortgage Rates.

. John in the above example makes. Estimate your monthly mortgage payment. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no.

Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

Ad See how much house you can afford. Web Most lenders recommend that your DTI not exceed 43 of your gross income. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web But there are two other models that can be used.

Ad Compare Home Financing Options Online Get Quotes. Skip The Bank Save. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Web Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service. Web Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Save Time Money.

Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Choose The Loan That Suits You.

Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt. Web Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. This rule says that you should not spend more than 28 of. Web This model states that your.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

Get Your Home Loan Quote With Americas 1 Online Lender. Top Second Mortgage Loans Reviewed By Industry Experts. Top Second Mortgage Loans Reviewed By Industry Experts.

For example if your monthly income is 5000 you can. 2 To calculate your maximum monthly debt based on this ratio multiply your. However how much you.

Get All The Info You Need To Choose a Mortgage Loan. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and.

Skip The Bank Save.

The Percentage Of Income Rule For Mortgages Rocket Money

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

How Much Of My Income Should Go Towards A Mortgage Payment

How Much To Spend On A Mortgage Based On Salary Experian

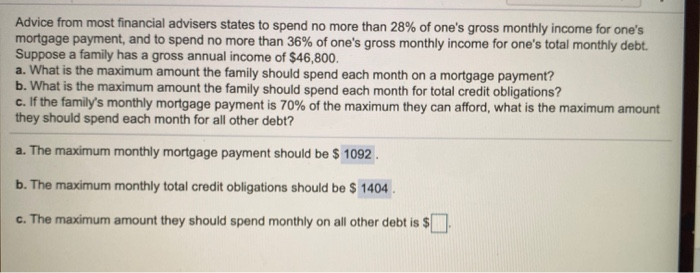

Solved Advice From Most Financial Advisers States To Spend Chegg Com

Loan Dsa Near Me Best Loan Dsa Near By Your Location Paisapaid Com

Mortgage Statement 10 Examples Format Pdf Examples

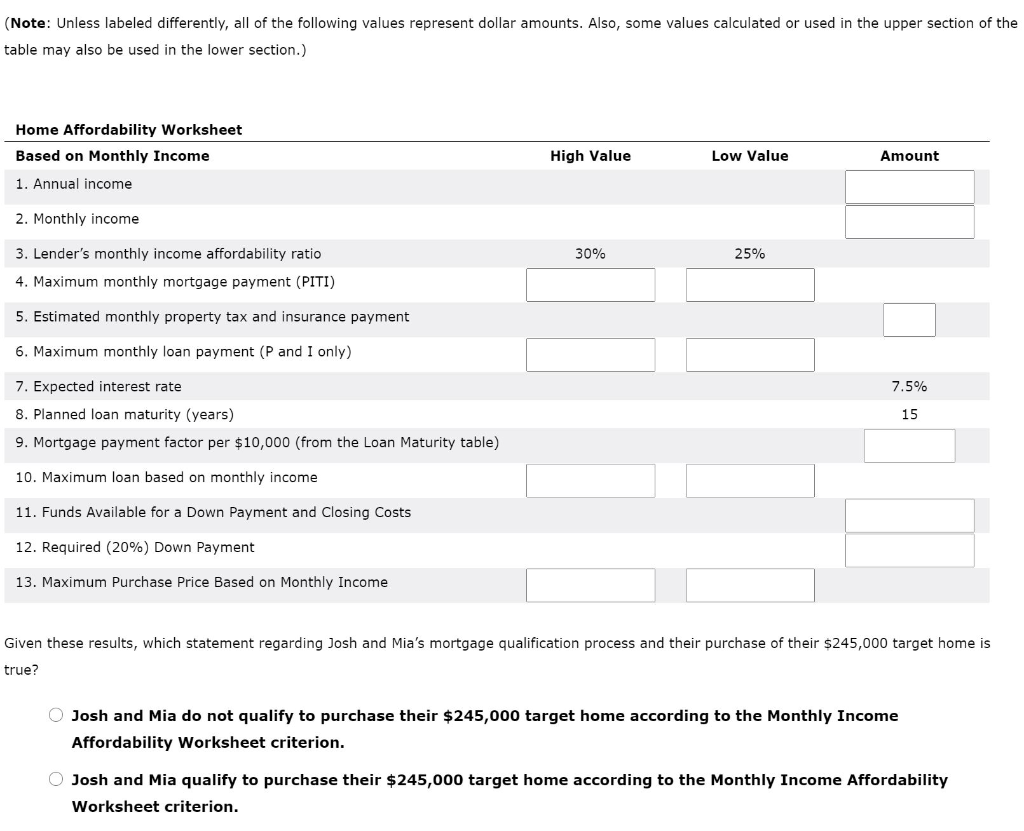

Solved Can Josh And Mia Afford This Home Using The Monthly Chegg Com

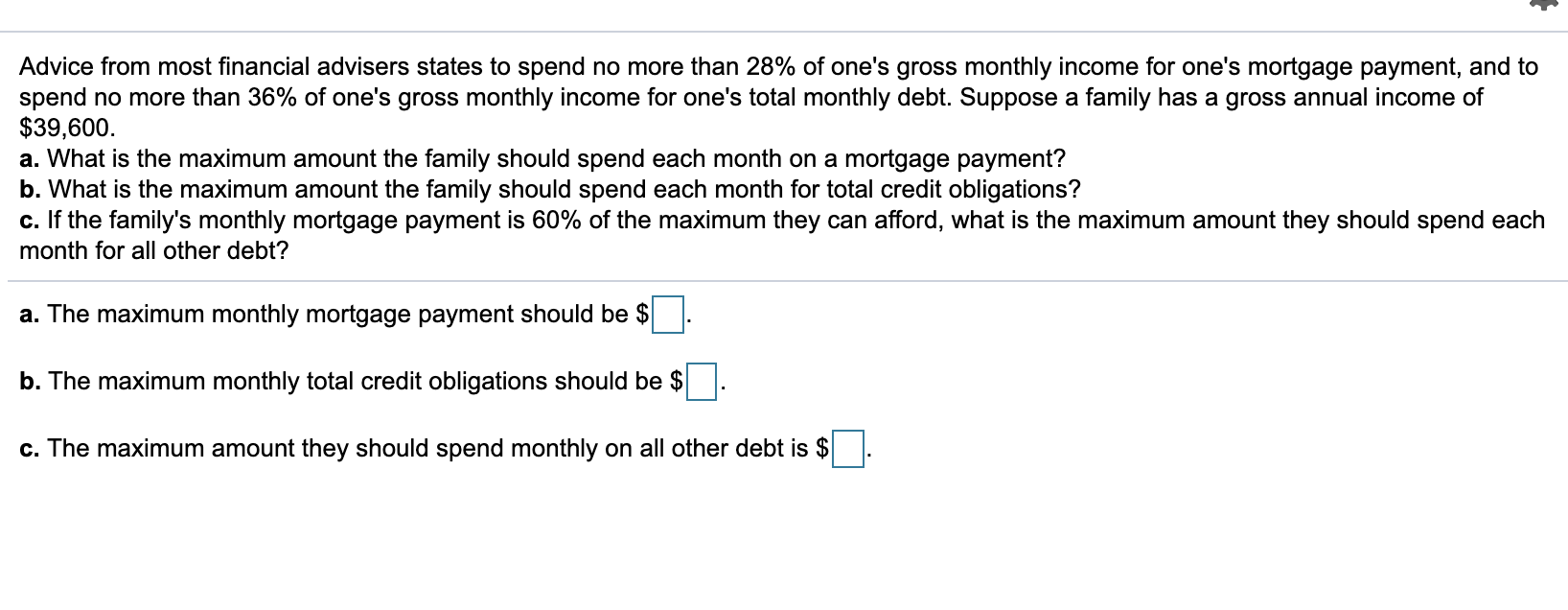

Solved Advice From Most Financial Advisers States To Spend Chegg Com

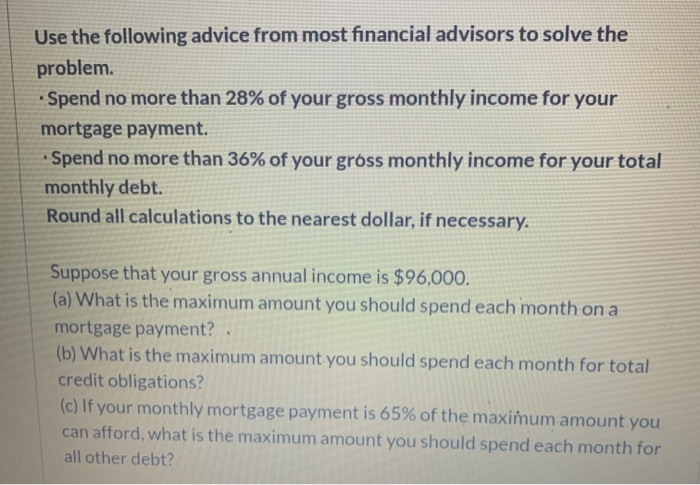

Solved Use The Following Advice From Most Financial Advisors Chegg Com

Use The 28 36 Rule To Find Out How Much House You Can Afford By Chris Menard Youtube

Nigerian Sustainable Finance Roadmap By Fc4s Issuu

Large Investors In Peerberry Are Growing The Most Peer To Peer Lending Marketplace Peerberry

What Percentage Of Income Should Go To A Mortgage Bankrate

How To Find Out If You Can Afford Your Dream Home

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Your Income Should Go To Mortgage Chase